Create a sample sheet, import your exchange and wallet data and let CryptoReports do all the work for you.

That’s all!

Prepare

Download and install CryptoReports from G Suite Marketplace

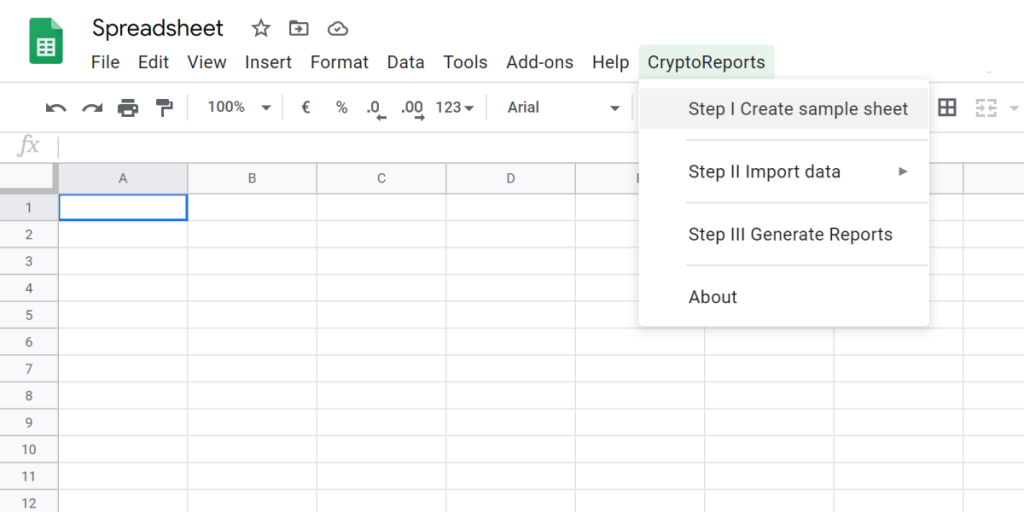

Step I

Create a sample sheet with some demo data.

Step II

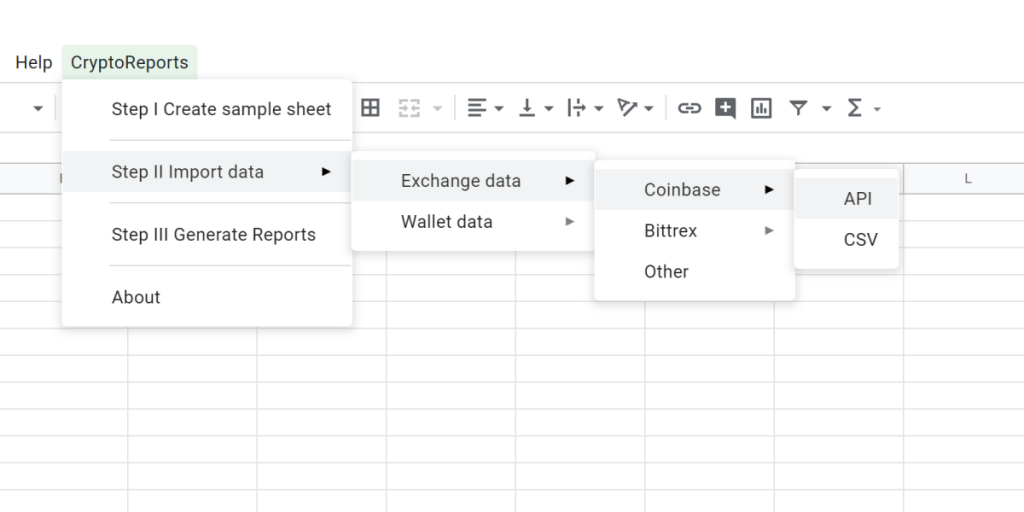

Import your exchange and wallet data via:

- API

The easiest and safest way to synchronize your data fully automatically with your exchange or wallet. - CSV

Export your transaction history directly from your exchange or wallet and import the data via upload.

Make sure all of your imported transactions are properly documented. Pay particular attention to the type and quantity of your transactions. Only correct data lead to correct reports!

Step III

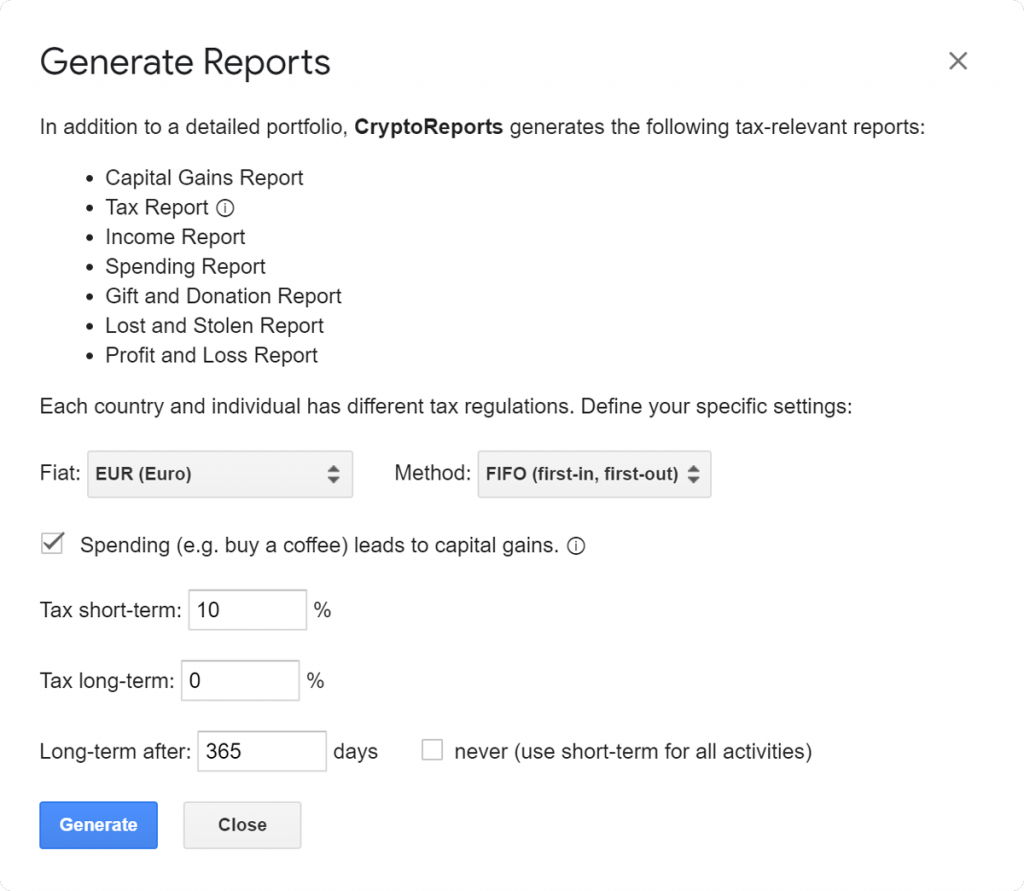

Finally, the imported data can be processed and reports can be generated from it.

Note that each country and individual has different tax regulations. Define:

- Your local Fiat currency

- Your preferred calculation method

- FIFO (first-in, first-out)

- LIFO (last-in, first-out)

- Whether spendings leads to capital gains

In most countries, asset outflows (even by buying a coffee) always leads to capital gains/losses that have to be taxed. - The tax rate for short-term/long-term cryptocurrencies (only for calculating the anticipated tax burden)

- The length of time until cryptocurrencies are classified as long-term.

Crypto tax calculation is a comprehensive process. We tried to make it as easy as possible for you. If you still have questions or problems with CryptoReports, please contact our support team. We are glad to help you!